Huge black hole in China's economic plan threatens global financial crash

Chinese officials have announced their ambitious plans to boost the country's economy, but there is one big issue at its core that could cripple these initiatives.

China recently announced its plans to focus on economic growth in 2024, but there's one big issue at the heart of their pledge that could make it impossible to achieve.

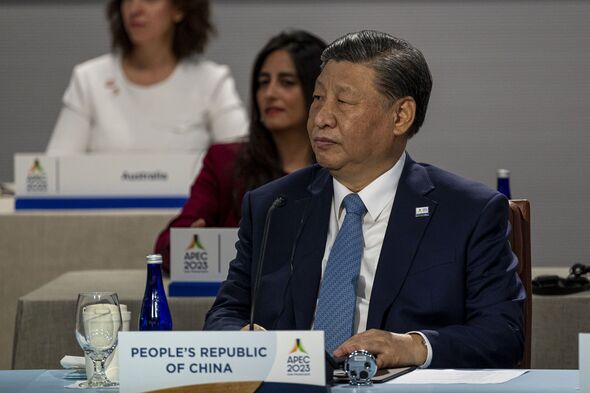

In the annual Central Economic Work Conference (CEWC) on Tuesday, China's top officials announced they would take economic growth more seriously next year, with a “focus on the central task of economic development and the primary task of high-quality development”.

They added: “Next year, we must persist in seeking growth while maintaining stability, facilitating stability through growth, and building the new before breaking the old.”

However, plans to boost consumer demand were woefully absent from the proceedings, which could make this a difficult or even impossible task.

Despite being more "pro growth" than usual, according to Larry Hu, chief China economist at Macquarie Group, the CEWC made no mention of any stimulus measures directly targeting consumers.

READ MORE: China economy close to 'vicious loop' threatening Beijing with financial chaos

President Xi Jinping headed up the meeting that set a GDP growth target of "around five percent" for 2024, roughly the same as this year's target. Analysts are arguing that this level of growth will not be possible without boosting consumer demand.

Citi analysts said: “[There was] no hint for massive consumption support policies. There was no detailed discussion on increasing household income.”

UBS analysts echoed this worry: "We think [the five percent level] would be very challenging to achieve, given the lingering growth headwinds and the modest policy support stance set in the Conference."

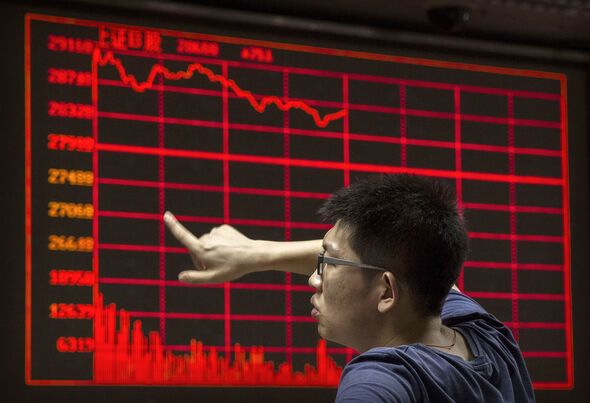

China is the world's second-largest economy, after the US, but it is currently suffering from rapid deflation that it cannot control, and low levels of consumption.

Policymakers are trying to increase consumer spending, to no avail. Previous methods have failed in trying to grow consumer demand, leading economists and government officials alike to push for more aggressive measures.

Don't miss...

'Get cash out of banks!' Warning world faces 'biggest crash in history' [LATEST]

China's economy in turmoil as major rating agency mulls downgrade . [INSIGHT]

Chinese economy in meltdown as millions of borrowers default [REPORT]

As well as deflation and low consumer spending, China's real estate slump is also at the heart of its economic problems. The housing industry used to account for as much as 30 percent of the country's GDP but experienced a crisis three years ago following a government crackdown on developers' reckless borrowing.

Now, they are trying to increase the construction of affordable housing, urban-village redevelopment and public infrastructure facilities in an effort to reenergize the property sector.

The sheer size of China's economy means that any changes to it and measures to boost will ripple through the global economy. The US credit rating agency Fitch said that China's slowdown was "casting a shadow over global growth prospects" and downgraded its forecast for the entire world in 2024".

Put another way, less money being spent on goods and services in China means less demand for raw materials and commodities from the rest of the world. In August, the country imported nearly nine percent less than August 2022, when it was still under Covid restrictions.

Ronald Rajah, director of the Indo-Pacific Development Centre, said: "Big exporters such as Australia, Brazil and several countries in Africa will be hit hardest by this."

These issues are at the core of China's economic worry, and until they are fixed, experts are concerned that any efforts to boost the economy in 2024 and beyond will fall flat.

Follow our social media accounts here on facebook.com/ExpressUSNews and @expressusnews